In changing the useful life and salvage value of its assets, Waste Management was able to reduce the amount of depreciation expense hitting the income statement. This is the key concept behind depreciation where an asset’s cost is recognized over many periods. The expense recognition principle requires that deprecation is recognized over its useful life. The matching principle and the revenue recognition principle are the two main guiding theories underlying accrual accounting. The matching principle also states that expenses should be recognized in a rational and systematic manner. In your description, please identify a journal entry that may have been used by Waste management to commit the fraud. Based on the case information provided, describe specifically how Waste Management violated the expense recognition principle. This also affected the balance sheet by overstating their assets. This affected the income statement and increased the carrying value of their assets. Considering that Waste Management was increasing the useful life and salvage value of its assets, they were deferring expenses such as depreciation and overstating its revenues. This principle is important for users of financial statements because matching revenues with expenses gives users an accurate picture of the company's profitability.

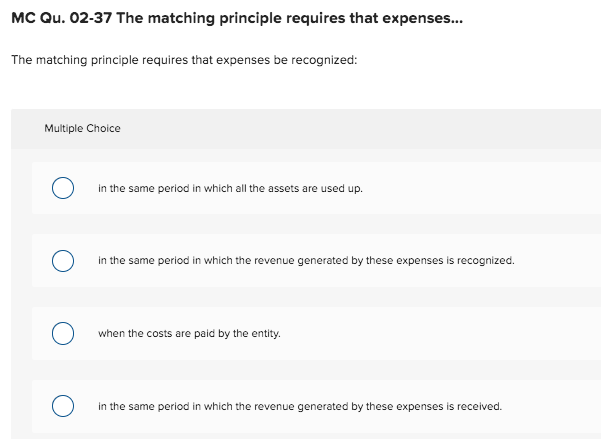

The expenses need to match the period in which the income was generated, regardless if cash was received when the work was substantially completed in that period. The expense recognition principle, also known as the matching principle, is a generally accepted accounting principle which states that expenses need to be recognized in the period in which they incurred. Define the expense recognition principle (sometimes referred to as matching principle) and explain why it is important to users of financial statements. Consider the principles, assumptions and constraints of Generally Accepted Accounting Principles (GAAP).

0 kommentar(er)

0 kommentar(er)