ZipBooks is a cloud-based accounting and payment processing solution designed for small and midsize businesses. With Xero, personal expenses can also be managed with mobile review and approval of each receipt. With Xero’s robust accounting features, small businesses can view their cash flows, transactions and account details from any location. Xero can be accessed from any device with an active Internet connection. Xero is a robust accounting solution with complex accounting features, ample reports, 700+ integrations, and unlimited users. QuickBooks solution offers customizable templates that can be branded with the business logo and desired field to generate invoices, bills, and reports.Īlso Read: Top 10 Early-Stage Startup Investors And VCs In Nigeria 8. The solution helps with bank reconciliation, tracking expenses, drafting invoices and monitoring financial reports, among others. QuickBooks Online is a web-based accounting solution that caters to individual accountants and small businesses. Sage One offers a neat set of templates for cooking up actionable templates so that late payments from clients due to invoice setup becomes a thing of the past for you. The firm has a strong base in Africa already, but that is just a tip of the iceberg – mainly because they have branches in other continents of the world too.

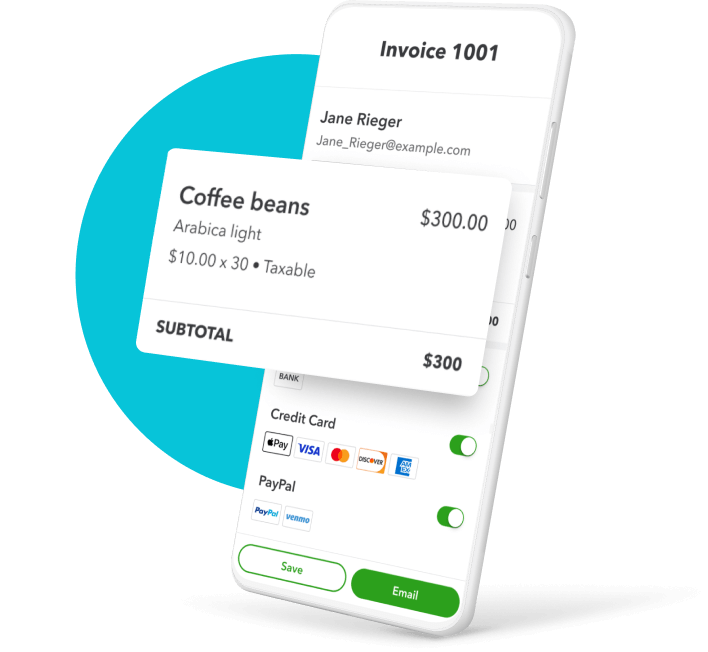

MOBILE INVOICING WITH QUICKBVOKS SOFTWARE

Sage One is business software that is targeted at small businesses with the aim to help them perfect all areas of their financing to aid easy and smooth operations. Used by over 100,000 businesses worldwide, invoicely brings with it all the basic functionality expected of billing and invoicing software such as invoice creation, payment schedules, and automatic reminders, workflow automation, managing of business accounts, and client information management, multi-currency support, and data import and export, to name some. Invoicely is a cloud-powered invoicing solution targeted at small businesses and freelancers. Automatic reminders, late fees, and the ability to accept deposits for work not yet done all make FreshBooks a great option for small business owners and freelancers.Īlso Read: 7 Essential Digital Marketing Strategies For Small Business Owners 5. You can customize your own invoice to match the style and message of your brand, and the ability to accept credit card payments right from the invoice adds to the sense of professionalism. Mobile invoicing makes Zoho a good choice for people on the go, and mobile access to their wide variety of other business tools is great for freelancers and small business owners who do a lot of traveling.įreshBooks’ invoices stand out as looking extremely professional. Zoho Invoice also integrates well with Zoho’s other suite of apps, which includes marketing, email, HR, and business process tools.

MOBILE INVOICING WITH QUICKBVOKS FREE

Even with the free account, you’re able to customize every little detail on your invoice to reflect your brand. Zoho makes it easy to create and send well-designed invoices. And if you use the Wave Accounting app for your small business, the invoices integrate right into your financial tracking.

Automatic status updates and payment receipts mean you don’t have to spend extra time managing the entire invoicing process.

Waveapps offers customizable invoices, recurring billing, and payment reminders, too. Waveapps offers a complete suite of billing and invoicing tools for small businesses and freelancers. It also supports collaboration as users can easily add team members and contractors to access accounts and projects.Īlso Read: Building A Small Business Vs. And at the same time, it also delivers the financing basics and intuitive customer experience any accounting newbie can appreciate. It provides more in-depth, specialized features than basic invoicing management software. The wonderful thing about Invoice is that it can work for almost everyone: it’s a good solution for freelancers and also business owners with a dozen employees. With Invoice, you can manage expenses, create invoices and estimates to send to your clients. What’s the best online billing software for you? To save you time answering that question, we’ve researched the most popular small-business billing software available on the market for Nigerian businesses. All you need is the right invoicing and billing software. Thanks to technology, it’s easier and more cost productive for non-accountants (such as yourself) to manage small-business finances. Especially if you’re just starting out, maintaining a positive cash flow can make or break your business. Financial management and bookkeeping is a challenge for most entrepreneurs and business owners.

0 kommentar(er)

0 kommentar(er)